Large industrial facilities lose more than a day’s worth of production each month and hundreds of millions of dollars a year to machine failures, according to a new report published in June by Senseye, the AI-powered machine health management company.

The True Cost Of Downtime report shares findings from a study of 72 major multinational industrial and manufacturing companies. It reveals that, on average, large plants lose 323 production hours a year. The average cost of lost revenue, financial penalties, idle staff time and restarting lines is $532,000 per hour, amounting to $172 million per plant annually.

Cumulatively, Fortune Global 500 (FG500) manufacturing and industrial firms are estimated to lose 3.3 million hours a year to unplanned downtime. The financial cost of this downtime to those organizations is calculated at $864 billion, the equivalent of eight percent of their annual revenues.

Alexander Hill, chief global strategist at Senseye, commented, “Unplanned downtime is the curse of the industrial sector. When expensive production lines and machinery fall silent, organizations stop earning, and those investments start costing rather than making money. The costs can spiral to well over $100,000 per hour for large manufacturers in almost all industrial sectors."

"With this report, Senseye has started to answer crucial questions, such as the true cost of downtime for large industrial organizations, and the kind of savings companies could make by using techniques such as predictive maintenance to help prevent breakdowns and reduce unplanned downtime.”

Victor Voulgaropoulos, Industry Analyst at Verdantix, the independent tech research and advisory firm, comments: “Senseye’s investigation into the costs of unplanned downtime highlights just how much untapped opportunity there is right now for industrial organizations to save money through widespread adoption of software applications and technology-enabled maintenance practices.”

Jim Davison, region director, South of England at Make UK, who represent manufacturers in the UK comments: “One of the biggest challenges manufacturers face is reducing the amount of unplanned downtime and the figures in Senseye’s report clearly show the huge cost impact of not doing this.

“What is clear, is that predictive maintenance can play a crucial role in not only reducing costs, but also boosting productivity at a time when manufacturers need to be using every tool at their disposal to meet the demands of an ever-changing industry.”

Cost of downtime is highest for automotive manufacturers

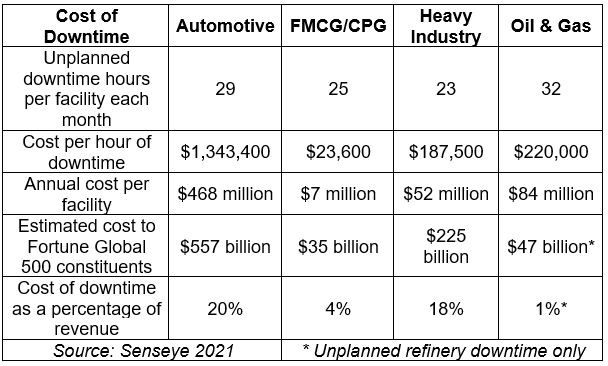

Unplanned downtime levels were highest in the automotive sector, where plants lost 29 production hours a month, on average, at the cost of $1.3 million per hour. As a result, FG500 automotive vehicle and parts manufacturers are estimated to lose $557 billion and 414,800 hours a year. 67 percent of automotive companies told Senseye that predictive maintenance was now a strategic objective.

Unplanned downtime levels were highest in the automotive sector, where plants lost 29 production hours a month, on average, at the cost of $1.3 million per hour. As a result, FG500 automotive vehicle and parts manufacturers are estimated to lose $557 billion and 414,800 hours a year. 67 percent of automotive companies told Senseye that predictive maintenance was now a strategic objective.

FMCG & CPG manufacturers lose 25 hours a month to unplanned downtime at the cost of $23,600 per hour. Across the FG500, this amounts to 1.5 million hours and losses of $35 billion a year. 72% of FMCG companies reported that predictive maintenance had become a strategic initiative.

Mining, metals and other heavy-industrial companies lose 23 hours per month of production time to machine failures at the cost of $187,500 per hour. This equates to 1.2 million unplanned downtime hours a year, costing FG500 companies in this sector $225 billion cumulatively. 60 percent of heavy industrial companies have made predictive maintenance a strategic priority.

Oil and Gas producers suffer 32 hours of unplanned downtime each month, on average, at the cost of $220,000 per hour - amounting to $84 million per facility. In refineries alone, losses to FG500 constituents are estimated to total $47 billion from 213,000 downtime hours. 82 percent of oil and gas respondents said predictive maintenance was a strategic objective, the most of any sector surveyed.

Two-thirds of manufacturers are focused on predictive maintenance

Senseye’s study also showed that more than two-thirds (72%) of large industrial organizations have made predictive maintenance a strategic objective and that one-in-five (20%) have established in-house predictive maintenance teams to lead these initiatives.

Approximately 51% of organizations said they already performed some condition monitoring and 87% that they collected at least some of the data that can be used to support predictive maintenance.

Download a copy of Senseye’s The True Cost Of Downtime report here.

Research methodology

The findings shared were obtained from 72 online interviews with maintenance, engineering and IT professionals at large-scale Automotive, FMCG, Heavy Industry and Oil & Gas companies in Australia, Austria, Brazil, Finland, France, Germany, Greece, India, Mexico, Morocco, Netherlands, New Zealand, Poland, Russia, Spain, Switzerland, Turkey, Ukraine, United Arab Emirates, United Kingdom and the United States. In addition, Senseye estimated the level of unplanned downtime experienced by Fortune Global 500 companies and related costs by extrapolating its research findings with publicly available information on the number of plants operated by these companies and the people they employ.

About Senseye

Senseye, headquartered in the UK with regional offices in Germany, France, the USA, and Japan, is the leading global industrial software solution for AI driven Machine Health Management. Senseye helps global industrial organizations to save millions of dollars in unplanned downtime and maintenance efficiencies every week in key industries such as Automotive, Manufacturing, Heavy Industry and FMCG.

This blog was originally published on and has been repurposed from Automation.com.