Harvard Business Review is predicting the peak of the impact of COVID-19 on global supply chains “will occur in mid-March, forcing thousands of companies to throttle down or temporarily shut assembly and manufacturing plants in the U.S. and Europe.” The activity of manufacturing plants in China has been significantly impacted by the outbreak, and they are not likely to return to full manufacturing capabilities for several months. HBR points out in a recent article that while most analyses compare the current pandemic with the 2002-2003 SARS epidemic, the relative importance of China in the global economic ecosystem has dramatically increased since that time and comparisons aren’t effective as a result. China has more than doubled its share of trade with the rest of the world, and a much broader scope of industries are now heavily or solely dependent on factories in China for parts and materials.

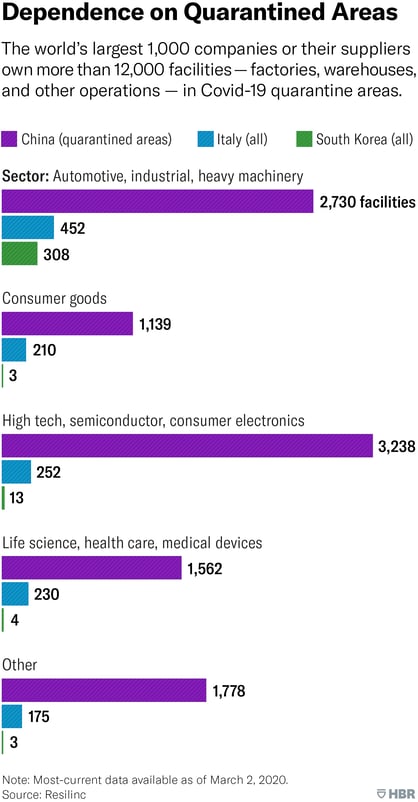

Resilinc, a supply chain mapping and risk monitoring company, has released data showing the number of sites of industries located in the quarantined areas of China, South Korea, and Italy, and the number of items sourced from the quarantined regions of China (see Figure 1). The data shows that the world’s largest 1,000 companies or their suppliers own more than 12,000 facilities in areas currently quarantined with COVID-19.

This research is backed by several other recent announcements, including:

- A survey by the American Chamber of Commerce in Shanghai released in February found that almost 80% of respondents in the manufacturing sector were unable to staff their production lines

- China’s recent “robotics revolution” has seen significant investment in robotics and other advanced automation technologies; the factories that are able to re-open will likely look for ways to leverage these technologies to boost their productivity

Read HBR’s full analysis, but here is a summary of the key elements for automation suppliers and asset owners:

- Most manufacturers will struggle to identify the full extent of the impacts of this pandemic on their supply chains, because they aren’t regularly monitoring their full supply chain; the vast majority of asset owners do not know the locations of suppliers that are providing parts and components that make up their systems

- Extensive supplier monitoring is more affordable than it used to be, and we’ve seen natural disasters, recalls, and now, a pandemic, wreak havoc on the supply chains of manufacturers in multiple sectors

- Supply-chain professionals understand the risk involved in single sourcing, but many are still stuck with only one option for critical parts of their supply chain because of cost or availability factors; sometimes the options are limited, and in many cases, the options are all coming from China

- Resilinc founder and CEO Bindiya Vakil, a founding member of the Global Supply Chain Resiliency Council and an Advisory Board member of the MIT Center for Transportation and Logistics, recommends using revenue impact and risk of supply disruption to build a response strategy for supply chain resiliency challenges; the multi-tiered framework is shown within the article linked above.

Figure 1: Used with permission from Resilinc

Figure 1: Used with permission from Resilinc