This post was authored by Roy Kok, vice president of sales and marketing at Ocean Data Systems.

In the world of industry and infrastructure, the wheels of technology turn more slowly, and strategic choices generally live on for decades. ARC Advisory Group has ascertained that the lifecycle cost for many technology solutions can exceed the initial cost of acquisition and installation many folds. Yet the emphasis for strategic selection often tends to be more about the upfront costs rather than lifecycle costs. This is likely due to the  difficulty in measuring and tracking lifecycle costs over time.

difficulty in measuring and tracking lifecycle costs over time.

A major contributor to the lifecycle cost comes in the form of spare parts and supplier services. Supplier services are typically the largest ongoing cost, and are an area that should be managed with a formal supplier relationship management process, to keep lifecycle costs in check. In my experience, few companies have adequate programs in place for measuring and managing the long-term costs of technology solutions ownership. Yearly reviews are typically foreshadowed by ad hoc calls to peers and remote plant sites, quickly polling for satisfaction and a current issues list.

Then, meetings with suppliers typically end up in a status quo or price increases based on new technology or market inflation.

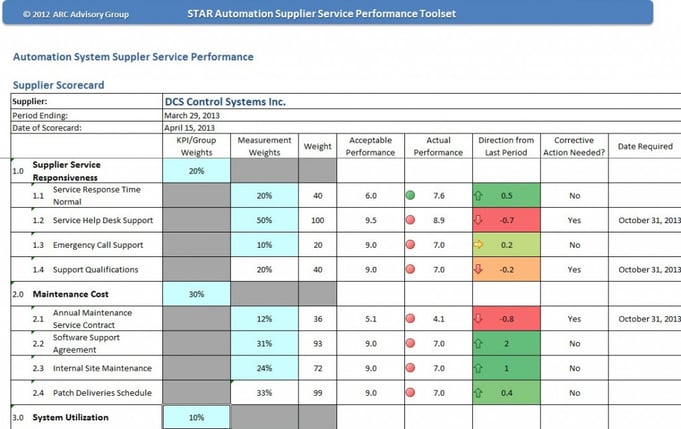

There is a better way. The solution involves using a set of supplier management KPIs for evaluating supplier performance across the organization in a fair and repeatable manner. These KPIs roll up into a supplier scorecard, making it the basis for a year-over-year supplier relationship evaluation.

The relationship KPIs and measures will vary across technologies. The following is a small sampling of measures for consideration in vendor relationship management:

- Service Response Measures – When an issue is logged, what is the response time? Is it consistent? How many transactions were required for resolution? How does after hour support compare with regular hours?

- Service Help Desk Support – What is the quality of the personnel you have access to? Is the service what you expect? What are hold times? Do you get the answer on the first try, or are you passed around?

- Emergency Call Support – What is the response time for an on-site call? Is the person equipped to handle the issue? Is the issue resolved with one visit?

- Parts Cost – How do parts costs compare with expectations? How are parts costs trending? What is the availability of parts? What is the turn around on repairs? What are spares inventories like? How often are spares updated?

- Maintenance Service Contract – How are contract prices trending? How many updates and versions are being delivered over a contract period? Are required updates handled in a timely fashion and what is the timing?

- Software Support Agreement – How many version updates are delivered? How quickly are software bugs being addressed?

- Supplier Maintenance Service Performance – What is the quality of scheduled maintenance and service visits? Is routine maintenance performed to expectations? Are services performed on schedule? Are additional costs incurred?

- Off Spec or down-graded production – How often are system issues responsible for a decline in production or product quality? What is the cost of your reduced production or quality?

- Unplanned Downtime – How often are system issues responsible for unplanned downtime? What is the cost of your downtime?

- Parts and Stock Availability – What are parts costs and availability. What are the turnaround times on repairs or stocking orders? These should be measured in value and time.

The key to supplier relationship management is selecting the most quantifiable metrics in your specific case. Metrics above are a great starting point and many may apply directly to you, but make sure they are measurable, both the first time and in subsequent evaluations. Also take into account how repeatable the results will be, even with changing personnel in your organization, or personnel distributed throughout the organization.

About the Author

Roy Kok is vice president of sales and marketing for Ocean Data Systems. Prior to Ocean Data Systems, Roy worked with ARC Advisory Group, the leading research and advisory firm for industry and infrastructure. As vice president of marketing, he was responsible for marketing all ARC products and services globally. Roy has had more than 30 years of experience in industry and automation with companies including Kaye Instruments, SyTech, Nematron, Intellution, VenturCom, GE, and Kepware.